Nov. 28. 2025Blog

Key considerations for unlocking Japan’s full cell & gene therapy and regenerative medicine potential

Cell and gene therapies and regenerative medicines (CGT&RMs) offer remarkable promise for treating various medical conditions. It’s no surprise, then, that the global CGT&RM market is booming,having received $22.7 billion of investment in 2021 alone.1

Accordingly, many countries have sought to ease the path to market for CGT&RMs. Among these, Japan has emerged as the go-to location for accelerated CGT&RM success.

However, companies must be aware of several regional considerations if they are to unlock Japan’s full CGT&RM potential.

Here we highlight what makes Japan so attractive to CGT&RM developers, discussing the unique regulations that could become bottlenecks for companies that are ill-informed or underprepared.

Japan: a landscape of CGT&RM opportunity

In our previous blog, we detailed some of the powerful features and capabilities that make Japan a uniquely attractive location for CGT&RM developers. These include:

1. A booming CGT&RM market, with no signs of slowing

Japan has already approved 19 CGT&RMs, spanning a whole host of modalities. And with Japan’s CGT&RM sector already valued at ~¥25 billion (~$185.5 million, as of March 2023) — set to grow to ¥1.1 trillion ($8.2 billion) by 2040 2 — CGT&RM developers have a huge opportunity to capture market share.

2. Growing demand for novel therapies

Japan’s aging population is equally attractive for companies with their sights set on CGT&RMs: the country has the highest proportion of elderly citizens in the world — and this is only set to grow.3

Critically, with an ageing population comes greater burden of many diseases resistant to current treatments, which means demand for novel therapies (such as CGT&RMs) in the region is — and will continue to be — high.

3. Enabling, CGT&RM-centric regulations

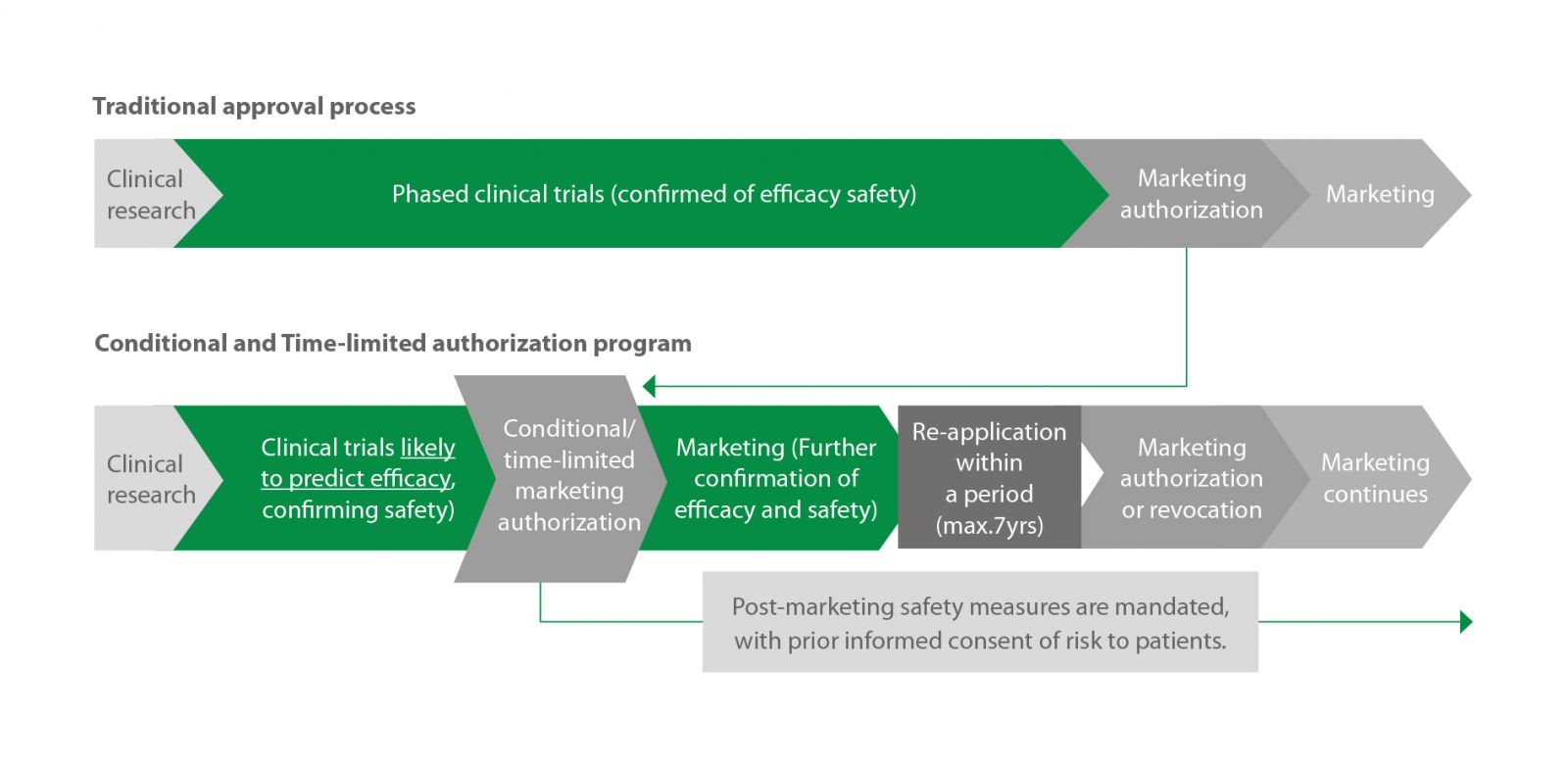

Perhaps the most attractive benefit of Japan is its CGT&RM-enabling regulations. In 2014, Japan enacted several regulations to streamline CGT&RM development. First is an expedited approval pathway introduced under the Pharmaceutical and Medical Devices (PMD) act, which lets developers bring their therapy to market much earlier, after demonstrating safety and presumable clinical benefit in early trials (figure 1).

Figure 1: Japan’s conditional and time-limited authorization program offers an accelerated route-to-market for promising CGT&RM products.

Similarly, the Sakigake Designation System facilitates development of innovative therapies that address severe and unmet medical needs. Here, companies get access to a wealth of development-supporting benefits, from shorter lead times for regulatory consultation to swifter New Drug Application (NDA) reviews.

Moreover, Japan has harmonized its regulations with other major regulatory authorities, such as the US FDA and the European Medicines Agency (EMA), to ease the regulatory journey for foreign developers.

Unique regulations demand careful consideration

The benefits noted above (as well as many others — check out our eBook to find out more) make Japan a CGT&RM force to be reckoned with.

But to make the most of this opportunity, companies must carefully consider several aspects of working in Japan.

Most important is the country’s unique regulatory landscape. While companies must always pay careful attention to local regulations — wherever they develop their products — the following two Japanese regulations demand special consideration, as they can catch underprepared companies off guard.

1. The Standards for Biological Ingredients

The Standards for Biological Ingredients (SBI) helps ensure products manufactured using biologically derived materials have the required quality, safety, and efficacy. Developers must meet a host of requirements, including confirming the eligibility of donors, checking raw materials are free of contaminants, and mitigating risks throughout manufacturing. Uniquely, developers need to prove they meet these requirements before clinical trials start.

Failing to understand and meet SBI requirements, to the correct timings, could ultimately mean companies end up needing an entirely new manufacturing approach or even an additional clinical trial.

2. The Cartagena Act

The Cartagena Act (CA) aims to assess and control the impact of genetically modified organisms (GMOs) (including viral-based vectors) on biological diversity. It demands GMO-using manufacturers conduct an environmental risk assessment (ERA). Unlike similar regulations elsewhere, companies in Japan must submit and have the ERA approved before clinical trials start. Completing the ERA is no easy feat either, involving large volumes of data, frequent communication with Japan’s regulators, and a complex and time-consuming review. The CA can easily become a program bottleneck for CGT&RM developers unfamiliar with Japan’s regulations.

Navigate unique regulations and unlock Japan’s full CGT&RM potential

However, these considerations need not be an issue for CGT&RM developers looking to tap into Japan’s CGT&RM opportunity.

With the right expertise and guidance, companies can smoothly navigate Japan’s regulations to ensure all of Japan’s CGT&RM benefits can be fully realized.

Discover exactly how best to navigate Japan’s unique regulatory considerations — and other top tips for maximizing chances of CGT&RM success in Japan — in our new information-packed eBook: “Tapping into Japan’s Opportunity in Regenerative Medicine and Cell & Gene Therapy”

References (Link to external sites) :

1) Alliance for Regenerative Medicine (ARM) Regenerative Medicine: The Pipeline Momentum Builds H1 2022

3) Japan External Trade Organization (JETRO) Investing Japan Life Science Report