Nov. 10. 2025Blog

Japan: A Unique Opportunity for Regenerative Medicine and Cell & Gene Therapy

With the ability to address some of the most challenging unmet medical needs, cell & gene therapies and regenerative medicines (CGT&RMs) have caught the attention of pharmaceutical and biotech companies the world over.

Indeed, the global CGT&RM market received a colossal $22.7 billion of investment in 2021, and more than 2,000 clinical trials were in progress in H1 of 2022 1.

As the sector continues to rapidly grow, Japan has emerged as a highly attractive location for CGT&RM development, manufacture, and commercialization. Companies looking to start or expand their advanced therapy portfolio would therefore do well to fully explore the country’s potential.

In this blog, we cover what makes Japan a CGT&RM powerhouse, highlighting three ways the region is helping pharmaceutical and biotechnology companies swiftly deliver safe and effective CGT&RMs to patients in need.

1. Japan’s booming CGT&RM market

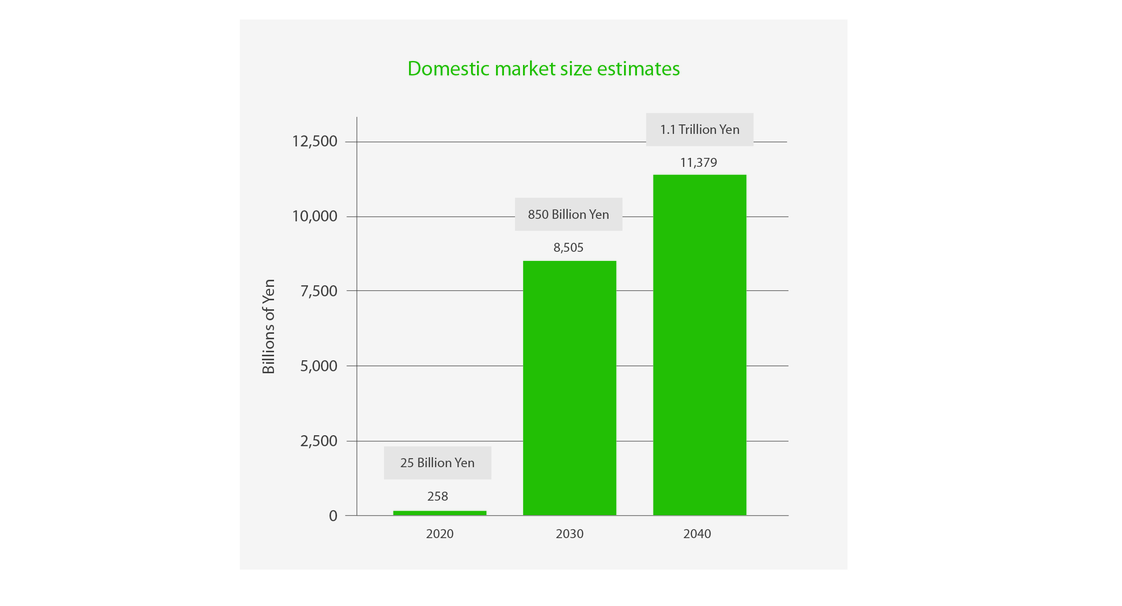

First, Japan has a large, well-established CGT&RM market where a product launch is highly feasible. To-date, Japan has approved 17 CGT&RMs, spanning a whole host of modalities — from tissue engineered products to treat heart failure, to autologous stem cell therapies for spinal cord injuries. Japan’s CGT&RM sector was recently valued at a whopping ~¥25 billion (~$185.5 million, as of March 2023). Critically, the market is set to grow to ¥850 billion ($6.3 billion) by 2030, and further still to ¥1.1 trillion ($8.2 billion, as of March 2023) by 2040 2.

Such a rapidly expanding sector offers pharmaceutical and biotechnology companies a significant opportunity to capture market share and grow healthy revenues from CGT&RMs developed and commercialized in the region.

Figure 1. Japan’s RM market is estimated to grow to ¥1.1 trillion ($8.2 billion, as of March 2023) by 2040. Adapted from AMED 2019 fiscal year market survey of regenerative medicine and gene therapy by Arthur D Little 2.

2. Growing demand for novel therapies

Japan’s population is also a significant attraction for CGT&RM developers. Japan is home to the highest proportion of elderly citizens in the world, with recent estimates suggesting as much as 29% of Japan’s population is older than 65. What’s more, this age group is only set to grow, potentially occupying ~35% of the total population by 2040 — a total of 39.21 million citizens 3.

And that poses significant challenges for Japan’s healthcare system.

For example, with an increasingly aging population, Japan is likely to face a growing burden of degenerative diseases and certain cancers, which are poorly treated with most current therapeutic approaches. Japan therefore urgently needs, and will continue to need, novel therapeutic interventions that are better equipped to address these conditions, such as CGT&RMs.

3. A success-enabling regulatory landscape

Perhaps one of the most exciting benefits of Japan for CGT&RM development, though, is the region’s enabling regulatory landscape.

Accelerated review and approval

To quickly realize the transformative benefits of CGT&RMs, Japan has made great efforts to ease route-to-market for these products, primarily through significant regulatory reform. Two regulatory changes in particular have drastically increased the speed at which these therapies can be delivered to patients.

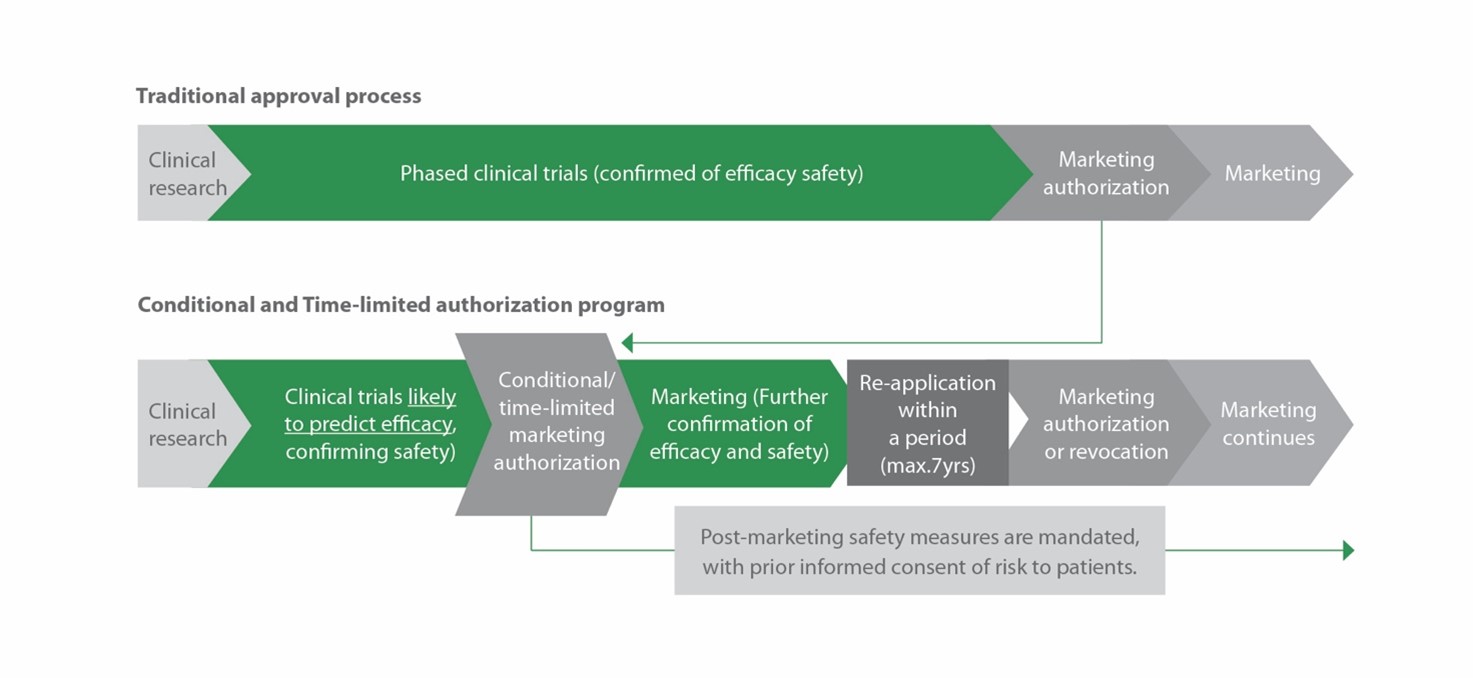

In 2014, Japan introduced a new, expedited approval pathway for CGT&RMs through the Pharmaceutical and Medical Devices (PMD) act, an update to Japan’s Pharmaceutical Affairs Law. Under the new act, developers can bring their therapy to market earlier than with traditional approval pathways, if they can demonstrate safety and presumable clinical benefit in clinical trials (figure 2). To secure full approval, developers must subsequently confirm the clinical benefit within the 7-year conditional approval period.

As of February, 2023, Japan has approved four CGT&RM products under the conditional and time-limited authorization program, demonstrating its value in helping get innovative products to patients in need.

Figure 2. The PMD act enables a significantly streamlined route-to-market for novel CGT&RMs.

In the same year, Japan launched the Sakigake Designation System, helping to facilitate development of innovative therapies (including CGT&RMs) that address severe and unmet medical needs. Under the designation, CGT&RM developers get access to shorter lead times for consultation with the Pharmaceutical and Medical Devices Agency (PMDA), as well as prioritized and shortened New Drug Application (NDA) reviews, and a potential 10-20% premium pricing increase, to name just a few advantages.

Harmonization and transparency

But Japan’s regulatory benefits don’t end there.

Japan has also gone to great lengths to harmonize its regulations with other major regulatory authorities, such as the US FDA and the European Medicines Agency (EMA), as well as making regulations highly transparent.

For instance, Japan’s regulatory agencies (along with the FDA and the EMA) helped establish the International Conference on Harmonization of Technical Requirements for Registration of Pharmaceuticals for Human Use (ICH) to support regulatory harmonization, and participate in the Pharmaceutical Inspection Co-operation Scheme (PIC/S) for harmonized Good Manufacturing Practice (GMP) requirements. As a result, Japan offers a smoother route-to-market for US- and Europe-based medical product developers, relative to other APAC geographies.

Japan’s commitment to harmonization is also clear from its frequent communication with the FDA and the EMA.

To help facilitate greater regulatory transparency, PMDA has made all regulations easily accessible online, and is also open to consultation with companies developing new products. In consultations, developers can expect to get detailed guidance and advice on a range of areas, from pre-clinical and clinical development to the data required for approval of advanced therapies, such as CGT&RMs. Companies can therefore better understand exactly what is needed for a successful product launch, enabling them to create more effective development strategies.

And that’s not all…

The market for CGT&RMs is booming, and pharmaceutical and biotechnology companies have many countries to choose from when it comes to new product development. However, Japan is emerging as a highly attractive option for developers, with its established and rapidly growing CGT&RM market, attractive patient population, and enabling regulatory framework.

But these are not the only benefits that make Japan an optimal choice for your CGT&RM program.

Download our new information-packed eBook, and explore the many other advantages of choosing Japan for CGT&RM development, manufacture, and commercialization, as well as the key considerations for fully unlocking the country’s potential.

References(Link to external sites):

1) Alliance for Regenerative Medicine (ARM) Regenerative Medicine: The Pipeline Momentum Builds H1 2022

3) Japan External Trade Organization (JETRO) Investing Japan Life Science Report